In this Coinbase One review, we’ll compare Coinbase One to a standard Coinbase account and also highlight the differences between Coinbase One and the platform it replaces, Coinbase Pro.

Coinbase packs a lot of features into its popular platform, but one common complaint is the higher cost of trading due to Coinbase’s fee structure. Coinbase One, a new offering from the leading US-based exchange, promises to change Coinbase’s premium-price reputation by replacing per-trade fees with an affordable fixed monthly subscription.

For frequent traders, Coinbase One, currently priced just under $30 per month, may offer a compelling value. However, Coinbase One may not be your best pick if you don’t trade high-volume. Similarly, if you only buy Bitcoin, there are now several ways to buy BTC with no fees — and without a monthly subscription.

Coinbase One Review: Overview

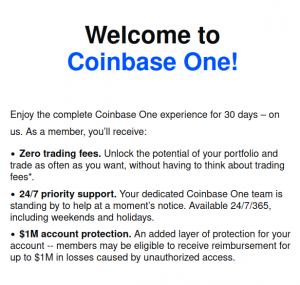

In addition to its no-fee structure, Coinbase One delivers two other key features: account protection and priority phone support.

- Account protection: Coinbase One offers up to $1 million in account protection. This means Coinbase One users may be eligible for reimbursement for losses due to platform breaches such as hacks. However, Coinbase’s protection is not available for losses due to user actions, such as sharing passwords or falling prey to phishing scams.

- Priority phone support: Online crypto exchanges aren’t known for their support, often limiting customer help to ticket systems or making support links difficult to find. Coinbase One upends this trend, assigning a dedicated team to the customer-service hotline and expanding coverage to weekends and holidays. Experience true 24-7 support.

Additional features:

- No-fee trades: You’ll pay about $30 per month for Coinbase One, but market trades come with no fees. Trade as often as you want in whatever size you need. However, limit orders still use a fee structure, and you’ll pay a spread fee for market orders.

- 30-day free trial: Try Coinbase One free for 30 days. After your 30-day free trial, Coinbase One renews at a $29.99 monthly membership fee. Offer limited to new Coinbase One members.

- 90-day free trial Messari Pro Analytics: A $90 value normally priced at $29.99 per month, Messari Pro lets you screen your picks to find the best trading opportunities. Unlock the power of advanced screening and charting features as well as daily crypto news and exclusive daily research.

- Easy tax prep: Crypto taxes are no fun, but Coinbase One takes the sting out of tax prep by offering a pre-filled Form 8949. File with confidence knowing your earnings are tracked accurately to the penny.

- Additional perks and features: Coinbase One is currently in beta. Expect some changes in the offering as the product evolves. Future membership perks may include higher payouts for staking or other value-added changes.

Coinbase One Pros and Cons

Like all trading platforms, Coinbase One has advantages and disadvantages.

Pros

Cons

Note: Coinbase does not directly support IRA investing. For tax-advantaged retirement savings, consider using a Bitcoin self-directed IRA.

Coinbase One Review: How Much Can You Save?

Experienced traders know trading on Coinbase can be spendy with a standard account. On smaller trades, you might be paying as much as 10% of your trade amount (or higher) in fees.

However, with Coinbase’s new paid option, you can trade as much as you want and as often as you’d like for one fixed price of about $30 monthly.

Trading fees are big business. Centralized crypto exchanges facilitated more than 14 trillion dollars in trading volume in 2021, with Binance making up the lion’s share of the trading market worldwide. In the US, however, Coinbase remains the largest platform, posting a record $3.6 billion in net income in 2021.

For someone who trades crypto daily or even multiple times per week, Coinbase One can make sense.

Here’s how standard Coinbase fees work:

| Trade Volume | Cost |

| Up to $10 | $0.99 |

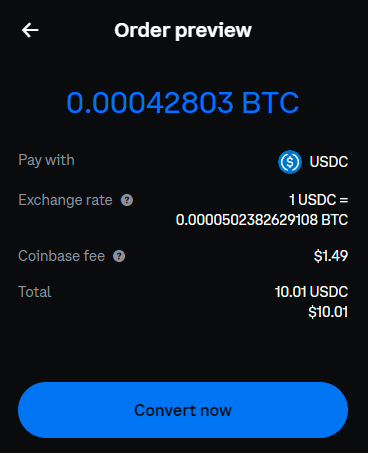

| $10.01 to $25 | $1.49 |

| $25.01 to $50 | $1.99 |

| $50.01 to $200 | $2.99 |

| Above $200 (Bank account or USD wallets) | 1.49% |

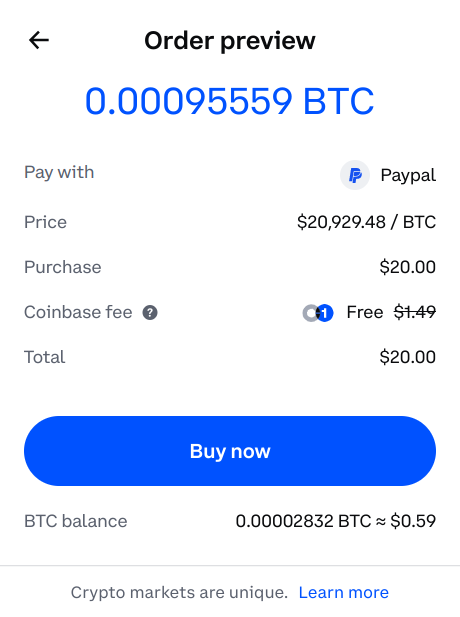

| Above $200 (Debit card or PayPal) | $3.99% |

If you’re buying more than $200 in cryptocurrency at a time, you’d pay at least $3 per trade using a standard Coinbase account funded through your bank account. After 10 such purchases or sales in one month, trading fees equal the cost of a Coinbase One membership.

When selling on Coinbase, you’ll pay a fixed fee of 1.49%. On Coinbase’s paid platform, the same sale becomes a fee-free trade. Often, crypto sales are for higher amounts than purchases, making sales fees an area to watch. At a 1.49% flat fee, a $2,000 sale would cost the same amount as a monthly membership to Coinbase One.

But for many traders, the value of Coinbase One is in its fixed cost. Predicting how much you’ll trade in a given month can be difficult. One month you might have no trading fees; the next, your trading costs might total $60, $70, $100, or even more. Coinbase One makes trading costs predictable and easy to budget if you expect to trade often.

Coinbase vs. Coinbase One

Both Coinbase gateways are really just two different ways to access the same assets. There’s no need to transfer balances from one to the other. Instead, when you join Coinbase One, all transactions fall under the new fee schedule, which for most trades equals zero cost.

Coinbase One can save you money in many cases if you trade in higher amounts or trade frequently. But you’ll also get some additional perks with your membership. You’ll enjoy dedicated customer support, available 24-7 and on holidays. You’ll also get up to $1 million in protection for unauthorized access to your account (some restrictions apply).

Both Coinbase platforms offer FDIC insurance on cash balances. However, FDIC insurance does not cover crypto balances, including cash equivalent stablecoins held on Coinbase, such as USDC.

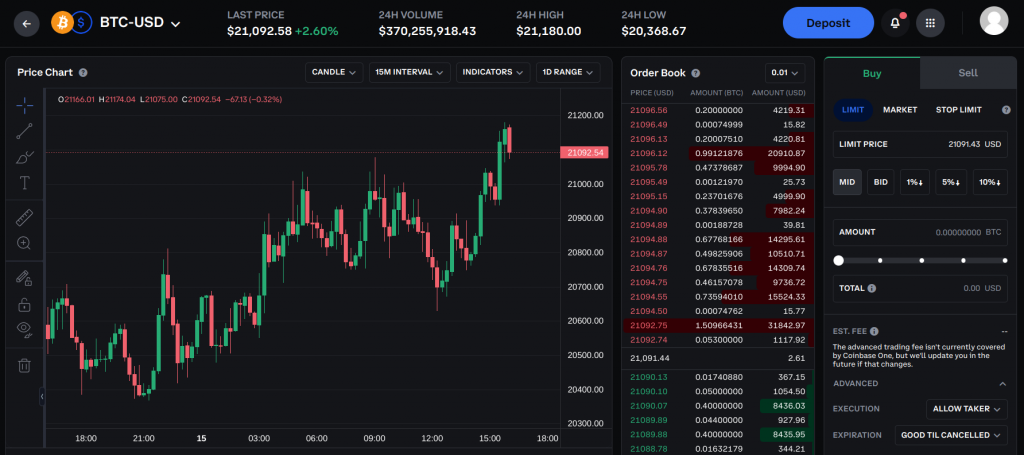

For technical traders or investors who need more precise tools, Coinbase now provides access to more trading tools using Advanced Trade, which is available on both trading platforms.

Powered by TradingView, Advanced Trade delivers a powerful set of tools that includes multiple chart types and indicators, limit and stop-limit orders, and trade history. With Advanced Trade, standard Coinbase account holders can leverage the volume-based trade pricing formerly reserved for Coinbase Pro.

Advanced Trade is now available at Coinbase.com and through Coinbase mobile apps.

Coinbase One vs. Coinbase Pro

First, it’s important to note that Coinbase Pro is being phased out by Coinbase. Going forward, your options include Coinbase’s standard platform and Coinbase One, although no retirement date has been provided for the Coinbase Pro offering.

Previously known as GDAX, Coinbase Pro uses a maker-taker model to calculate trading fees. If you’re taking liquidity (existing trade offers) off the exchange, you’ll pay a higher taker fee, typically about 0.6%. However, you’ll pay the lower maker fee if your order creates liquidity for others because it can’t be filled right away. Maker fees typically run about 0.4%.

As an example, a $2,000 trade that fills immediately would cost $12.00 in fees on Coinbase Pro.

While Coinbase Pro can be much less expensive than Coinbase’s standard platform for larger trades, there is no fixed monthly subscription option with Coinbase Pro. This means your fees might be higher than Coinbase One’s $30 subscription during months with high trading values or more when you trade more frequently.

As another consideration, traders who used Coinbase Pro and the standard platform had to transfer assets from one platform to the other depending on where they wanted to trade. Because both are owned by Coinbase, transfers are free and instant, but the extra step can be cumbersome. By comparison, Coinbase and Coinbase One share the same wallet, so no transfers are necessary.

Coinbase One Review: Who is Coinbase One For?

While ideally suited to high-volume traders or investors who make larger trades, Coinbase One can be a good fit for many crypto investors. Whether Coinbase One’s fixed-price membership is a fit for you depends on how you trade.

Coinbase One may be best for:

- High-value trades: Percentage-based commission fees add up quickly if you’re making high-value transactions. Without Coinbase One, a $5,000 purchase or sale can cost nearly $75.00.

- Frequent trades: Standard Coinbase fees take a big bite out of earnings if you trade often. Because purchase fees vary based on the transaction amount, you could be paying more than 10% for smaller transactions. Coinbase One fixes this by offering all-you-can-eat trades with a $30 per month subscription.

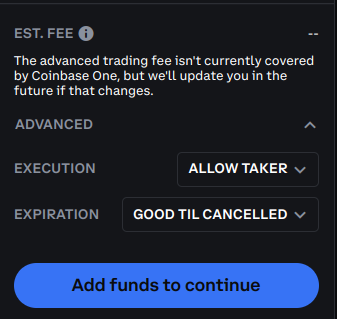

- Market trades: At this time, Coinbase One’s fee-free schedule does not include limit orders that allow you to place an order for a fixed price. Limit and stop-limit orders still incur a fee. However, if you typically buy with market trades, frequent traders or high-value traders can save with Coinbase One.

- PayPal or debit-card-funded transactions: You get fee-free trades even for purchases funded by PayPal or debit cards.

Low-Fee and No-Fee BTC Alternatives

If all or most of your trades are BTC/USD, you have several other options to trade Bitcoin with low fees or no fees at all. And there’s no membership fee.

While some options don’t offer a wide selection of cryptocurrencies, Bitcoin-focused investors have free or low-fee ways to trade BTC.

Binance.US

- Binance.US: No fees for BTC trades. Eligible pairs include BTC/USD, BTC/USDT, BTC/USDC, and BTC/BUSD.

Binance.US is the US-only exchange offering from Binance, the world’s largest centralized crypto exchange.

Strike App

- Strike.me: No fees for BTC trades and free transfers to private wallets.

Perhaps best known as a payment app, Strike also offers an exceptional way to purchase Bitcoin with no fees. Make spot bitcoin buys or set up automatic purchases of as little as $0.50 each. Purchase Bitcoin hourly, daily, weekly, or monthly on autopilot.

Note: Strike requires a chrome extension (or mobile app).

Swan Bitcoin

Do one thing and do it well. That’s Swan Bitcoin. Enjoy low-cost Bitcoin purchases (currently less than 1%) combined with industry-leading security. You also have the option to withdraw to a private wallet automatically with no additional fees.

Coinbase One Review: New Customer Promotions

Coinbase makes it easy to get started with Coinbase One and offers a few promotions to entice new users. If you already have a Coinbase account, you may also qualify for a free 30-day trial of Coinbase One.

- 30-day free trial: Currently by invite only, cancel anytime.

- Get $10 in free Bitcoin: New users can earn $10 in free Bitcoin for joining Coinbase, paid after trading $100 in crypto.

Coinbase Perks and Extras

For those new to Coinbase, several perks of the platform make Coinbase worth a closer look.

- Crypto rewards card: Earn up to 4% back in crypto for everyday spending with the Coinbase Visa rewards debit card. Fund your card with USDC or spend crypto kept on Coinbase. Reward choices change each month, and Coinbase usually offers a 1% or higher BTC rewards option. Rewards are paid monthly.

- Wallet: Coinbase offers a multicurrency wallet that’s separate from the exchange. Take custody of your crypto and keep your coins out of harm’s way.

- Interest on USDC: If you keep USDC on Coinbase between trades or to fund your Coinbase card, Coinbase pays a small percentage (currently 0.15%). It’s not a life-changing yield, but you’ll get paid to avoid volatility risk while planning your next move.

Risks of Using Coinbase

Using Coinbase or Coinbase One doesn’t bring outsized risk in comparison to other well-established exchanges. Coinbase offers two-factor authentication that helps ensure secure access. Coinbase One adds an additional layer of assurance in the form of insurance against unauthorized access.

However, as with any exchange, the primary risk is in keeping your coins or tokens on the exchange rather than in a private wallet. On-exchange coins and tokens can be at risk from hacking attempts or government actions.

Liquidity issues or financial pressure can lead to delayed withdrawals or, on some exchanges, situations in which the exchange holds less crypto than it has promised to account holders. To avoid losing the game of cryptocurrency musical chairs (should it begin), it’s always wise to remove larger holdings from exchanges.

At the end of Q1, 2021, Coinbase had over $6.3 billion in cash, down from $7.2 billion at year-end 2022, but up significantly from Q1, 2021, when cash on hand was just $2.1 billion.

Should You Choose Coinbase One?

If you’re just planning to buy Bitcoin, there are less expensive ways to make that trade in many cases. Strike offers a fee-free way to stack sats in smaller quantities. Swan Bitcoin and Binance.US offer attractive ways to buy BTC in larger amounts.

But Coinbase One brings unique benefits for many traders, particularly if you trade a wider range of assets or trade in higher volume. Coinbase One is also attractive if you trade multiple types of crypto assets.

At $30 per month, frequent traders and investors who make larger trades can save significant trading costs. And with no obligation or long-term commitments, matching your membership to your anticipated trading needs is a breeze.

You can always upgrade to Coinbase One as your needs dictate. Starting a Coinbase standard account is free.

Frequently Asked Questions

How Much is a Coinbase One Subscription?

A Coinbase One subscription costs $29.99 monthly.

Can I Cancel Coinbase One?

You can cancel Coinbase One anytime without affecting your standard Coinbase account. Both Coinbase and Coinbase One access the same balances and accounts, so canceling your membership leaves your Coinbase account and balances intact. Future trades revert to the fee schedule used by Coinbase for standard accounts.