If you purchased Bitcoin in 2021, you might have paid as much as $69,000 for one Bitcoin. By mid-2022, you could pick up a Bitcoin for under $20,000.

It’s tough to know when to buy, but when you dollar-cost average bitcoin, you take the guesswork out of buying.

Remember that tortoise in the fable, the one that outpaces the hare in the end? That’s you when dollar-cost averaging. Slow is fast.

If you had dollar-cost averaged your Bitcoin (BTC) purchases through 2021 and 2022, as in the examples above, you’d have some purchases at $69,000 and some at under $20,000. But a larger percentage of your Bitcoin would have a price tag toward the lower end of the range.

As time passes and the price of Bitcoin rises relative to your average cost, the benefits of dollar-cost averaging become apparent.

How Does Dollar-Cost Averaging Work?

Dollar-cost averaging refers to timed purchases for the same amount, allowing you to build a position over time and without the (often incorrect) guesswork that can accompany other buying strategies.

Let’s face it. Most investors don’t understand technical trading charts well, and even fewer understand why equities or commodities sometimes don’t follow the technical trading rules we do know.

Timing the market incorrectly can cost hundreds, thousands, or even more, depending on how much you invest. Time amplifies these trading errors., but it can also amplify the effects of our sound choices, like dollar-cost averaging.

Instead of guessing, reading charts, reading tea leaves, throwing darts, or rolling dice, dollar-cost averaging embraces imperfectly-timed trades, blending the well-timed with the clearly questionable to build a position that’s weighted toward lower-cost buys.

In the context of Bitcoin, an asset known to lose more than 80% of its value before recovering to new all-time highs, dollar-cost averaging isn’t just a smart way to invest. It may also be the only way to keep your sanity.

For example, for Bitcoin, you can look at the past few years to get an idea of how dollar-cost averaging can work to your advantage.

On July 15, 2021, Bitcoin (BTC) closed at $31,421.54, according to CoinMarketCap. A year later, Bitcoin closed at $21,190.32.

Assuming you invested $1,000 on each date, you’d own more Bitcoin at $21,000 than at $31,000. The bad news is that you’re down about $325 on your investment overall.

Taking the same exercise back one more year, BTC closed at $9,132.23 on July 15th, 2020.

If you invested $1,000 on July 15th of each year, from 2020 to 2022, you’d have invested $3,000. In this example, however, you have a paper profit of $ $994.78 because you bought more than three times as much Bitcoin at $9,100 compared to the purchase you made at $31,000.

This example uses an annual investment to keep the math easy. In most cases, you’ll invest more frequently, such as monthly, weekly, or even daily.

Dollar-cost averaging can make any investor look like a genius, assuming the asset ultimately goes up in value. However, if the asset ultimately goes down in value, dollar-cost averaging simply adds more time to the process of losing money.

Bitcoin Dollar-Cost Averaging Examples

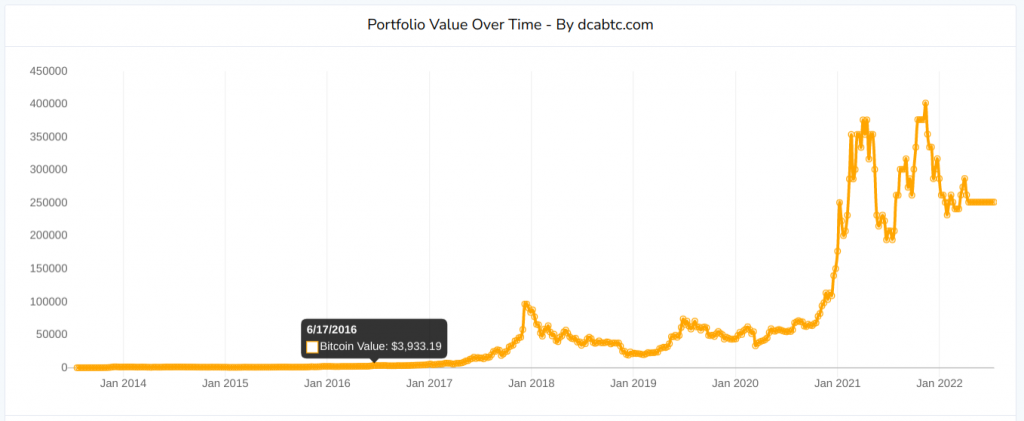

The amount you invest and the frequency of your investment play a big role in long-term performance. As with most investments, the length of time you’re invested also plays a significant role in investment performance. Time smooths out the peaks and valleys, forming a smoother trend line as you zoom out to see the big picture.

Here are some dollar-cost averaging examples based on historical Bitcoin prices:

| DCA amount | Frequency | Duration | Invested | Final value |

| $10 | weekly | 9 years | $4,700 | $252,540 |

| $10 | weekly | 5 years | $2,610 | $11,603 |

| $10 | daily | 9 years | $32,870 | $1,749,517 |

| $10 | daily | 5 years | $18,260 | $80,758 |

| $40 | monthly | 5 years | $2,400 | 11,026 |

| $20 | biweekly | 5 years | $2,620 | $11,697 |

In the table above, duration plays the biggest role. Time can deliver astounding gains, but you have to be in the market. Dollar-cost averaging helps ensure that you’re always investing and always building.

Notice the last two rows in the table, however. $40 monthly seems similar to $20 every two weeks, but there’s a difference that can add up over time. There are 4.25 weeks in a month on average, so the biweekly schedule results in more money invested as well as higher gains based on historical Bitcoin prices.

The Effect of Fees on Long-Term Performance

Fees are part of life in the investment world. But it’s easy to overpay, particularly when making smaller purchases. When considering an exchange or platform, research the fees involved with purchases.

For example, on one well-known exchange, a $10 purchase of Bitcoin could cost $0.99 in fees. In this example, if you invested $10 weekly, you’re really only putting $9 to work. The exchange takes $1 in this real-world example.

Here are some examples of how that might look over time using historical Bitcoin prices.

| DCA amount | Frequency | Duration | Invested | Final value |

| $10 (no fee) | weekly | 9 years | $4,700 | $251,456 |

| $9 ($1 flat fee) | weekly | 9 years | $4,230 | $226,310 |

It’s easy to dismiss the impact of the trading fee. After all, it’s only a dollar in this case. But that dollar, on every purchase, costs over $25,000 in gains in the example above, all in less than a decade.

The same exchange will charge about 1.5% if you need to sell your Bitcoin, another $3,400 if you need to sell the entire $226,000.

For some types of cryptocurrencies, there’s no way to avoid high fees. In many cases, the only way to buy tokens is on a decentralized exchange where trading costs can be even higher.

But if you’re buying Bitcoin, there are several ways to build your stack without paying high fees and without sacrificing security.

Low-Fee and No-Fee Bitcoin Trading

Bitcoin finds itself in a unique place in that you can buy Bitcoin with no trading fees. Some platforms charge a small fee but bring other value-added services such as cold storage or automated investing. The latter of these features is a perfect way to dollar-cost average Bitcoin purchases as you build your position.

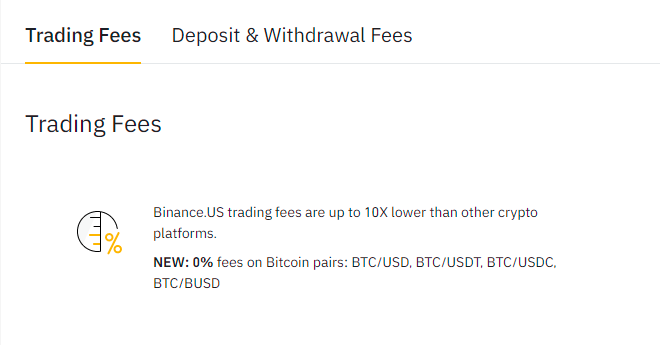

Binance.US

Perhaps best suited to those who want to diversify with other crypto assets, Binance offers a wide selection of coins and tokens with trading fees lower than some well-known competitors.

But if Bitcoin is your jam, Binance becomes a powerful tool for dollar-cost average Bitcoin purchases because there are no fees for USD-based BTC trading pairs.

Trading pairs refer to trades of this (asset) for that (asset). You can buy Bitcoin on Binance with no fees using USD. Binance also offers no-fee BTC trades for the following stablecoins:

- USDT (Tether)

- USDC (US Dollar Coin)

- BUSD (Binance USD).

Binance allows automatic purchases on your schedule.

- Daily

- Weekly

- Biweekly

- Monthly

ACH-funded transactions require a 10-day hold before you can withdraw. Similarly, debit card transactions are subject to a 3-day hold before you can withdraw.

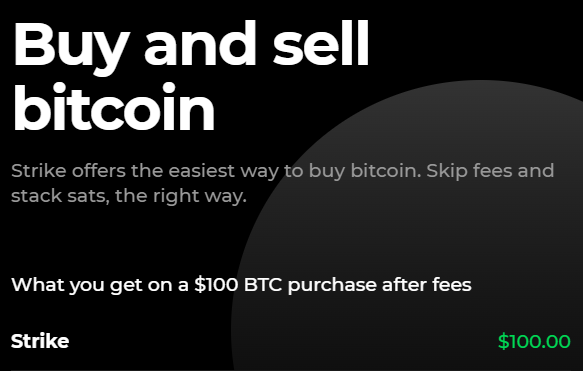

Strike.me

Founded by Jack Mallers, the high-energy Bitcoin entrepreneur who brought Lightning Network payments to major retail chains, Strike combines the convenience of a mobile payment app with the ability to buy no-fee Bitcoin.

Strike’s flexibility embodies the idea of dollar-cost average Bitcoin buys. Set up automatic purchases for as little as $0.50 and set a purchase frequency as often as hourly. You’ll get a notification when each purchase executes successfully.

Automatic Bitcoin purchase options:

- Hourly

- Daily

- Weekly

- Monthly

There’s no option for biweekly purchases with Strike, but with fee-free Bitcoin and support for transfers to self-custody wallets, it’s easy to forgive.

Strike also allows direct deposit and automatic conversion of all or part of your pay to BTC with no fees. A debit card is in the works as well.

When the time is right, Strike lets you sell or spend your Bitcoin easily and with the same no-fee experience.

Note: Strike requires the Strike chrome extension or Strike mobile app.

Swan Bitcoin

In just two short years, Swan has established its place as a trusted and cost-effective way to buy Bitcoin. With services designed for buyers at any level, Swan provides value to beginning investors making their first $10 trade or high-net-worth individuals who have specialized buying and storage needs.

Swan Bitcoin offers a galaxy of educational information for buyers at any level of experience. Learn the basics of wealth-building through Bitcoin or discover something new about Bitcoin and the way it can change the world as well as our worldview.

Bitcoin, explained for non-techies.

Swan’s focus is on safety, helping investors navigate this new opportunity, and even taking a vocal position warning against some of the more dangerous neighborhoods in the cryptosphere.

Bitcoin trading on Swan isn’t free, but it is affordable and easy to fit into any budget. You’ll pay just under 1% for Bitcoin trades, and transfers to your private wallet are on the house. When you’re ready to withdraw to a self-custody wallet, you can set a limit for automatic withdrawals.

Swan’s options for dollar-cost average Bitcoin purchases include:

- Daily

- Weekly

- Monthly

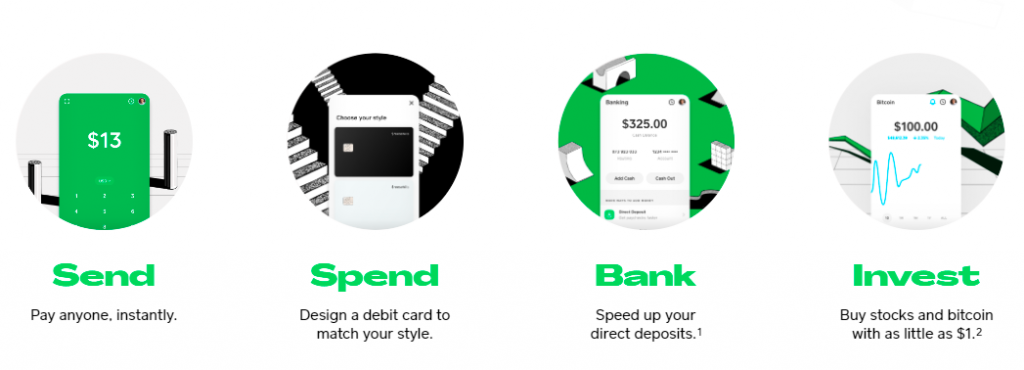

Cash.app

As its name suggests, Cash App is a mobile-first app. You can access some of Cash App’s basic features through a browser. But to purchase Bitcoin, you’ll need the mobile app.

Cash App isn’t free for Bitcoin trades, but it is affordable, particularly for small purchases. For most trades, you’ll pay just over 2%. So, for a $10 trade, expect to sacrifice about 22 cents to trading fees. Not bad.

Cash App also allows withdrawals to a self-custody wallet, but you’ll need to withdraw at least 0.001 Bitcoin at a time, currently about $25 USD.

Automatic investment options are more limited with Cash App. You’ll have the following buying choices:

- One time

- Daily

- Weekly

- Biweekly

Auto Invest, as Cash App calls its DCA service, also requires a $10 minimum purchase. However, one-time purchases can be as little as $1.

Cash App shares a similar market to Strike, and you’ll find some overlap in the services each app provides. From a Bitcoin buyer’s perspective, Strike is more cost-effective. However, with over 44 million users and several other useful features, Cash App earns its place in the discussion.

The Temptations of Market Timing

The emotional pull caused by fear of missing out and the temptation to catch a falling knife can both be detrimental to your portfolio. Emotion, in general, has no place in investing. Both euphoria and fear can lead to regretful financial decisions.

Dollar-cost averaging takes the emotion out of investing. Instead of deciding when to invest or how much to invest this time, you just set a fixed amount that fits your budget and choose an interval that works with your household’s cash flow.

For example, if you get paid biweekly, you can set up an automatic investment to buy when your paycheck clears. The concept has been around as long as investing and saving have been a thing: pay yourself first.

This strategy also keeps you from spending the money on ice cream cones or overpriced coffee. If you’re disciplined in your investment approach, you’ll likely have plenty of money for coffee and ice cream later.

If you’re a technical trader (and you’re good at it), you might choose to dollar-cost average your Bitcoin purchases only when you think the market is trending up, pausing when the market is headed down. This strategy can work, but Bitcoin can also be volatile, and you won’t get much notice before the price changes direction again.

For most of us, the safest way to build our stacks of Bitcoin is to dollar-cost average, buying a fixed dollar amount on a fixed schedule.

Potential Disadvantages of Dollar-Cost Averaging

Dollar-cost averaging comes with its risks. Anyone who used DCA through 2021 probably bought some Bitcoin at $69,000 or a similarly high number. As of this writing, BTC is at just over $23,000. That’s a risk, but only if you plan to sell soon.

Using DCA would have also netted some BTC at under $18,000 recently. And by investing the same amount at regular intervals, you’ll end up with much more Bitcoin at lower prices than at higher prices.

The disadvantage to dollar-cost averaging is that it’s not compatible with technical trading, guessing, wishing, hoping, or most other methods of making a trading decision. It’s just steady. Relentless, perhaps. For many of us, that’s a good thing.

Dollar-Cost Average Bitcoin Buys: Staying the Course

Time heals all wounds, including those we may have self-inflicted by (flawed) market timing or emotional investment decisions. Dollar-cost averaging offers a safer way to build your nest egg over time, leveraging disciplined purchases at fixed intervals.

Set it and forget it. That’s all DCA is. Sometimes simple is better.

If you’re still curious, visit dcaBTC to experiment with the effects dollar-cost averaging can have for Bitcoin using historical price performance. Past performance doesn’t guarantee future results. But it can be eye-opening to see how a disciplined approach can deliver outsized returns while also bringing more safety by taking emotion out of the equation.

Frequently Asked Questions

How do you use dollar-cost averaging in crypto?

To use DCA with Crypto, you choose an amount you want to invest and split the investment into purchases at regular intervals. For example, if you want to invest $100 total, you can invest $10 per week for 10 weeks. Alternatively, you can continue investing fixed amounts at regular intervals to build a larger position over time.

Is dollar-cost averaging a good idea?

Dollar-cost averaging uses a disciplined approach to take the emotion out of investing. It can be easy to miss entry or exit points with other investment methods. Instead, DCA ensures you’re always building your position and buying more when prices are lower.